Occasionally you come across buyers that engage your firm self-prescribed and self-diagnosed. You can tell by the way these buyers make requests: “We want to file this report; draft this kind of contract; do that kind of audit; create a website just like that; design a building just like this one, etc.”

It appears, these buyers are fully aware of what they want and how they want it done. Typically such buyers had some prior experience with the kind of services you provide. However, some buyers only pretend to know what they want, and some, having read a couple of awareness-level pieces of content, are under the impression that they now do. As a professional, it is your responsibility — in everyone’s best interest — to distinguish which type of buyer you’re dealing with.

Since there is often resistance among leadership of professional service firms (PSF) with accepting that their firm is, in fact, very similar to other firms in how buyers approach them, in an attempt to avoid triggering defense mechanisms, I will provide an example everyone can relate to.

The following story comes from my personal experience.

Are you mad!? This doesn’t cost that much!

Back in the day I used to run a construction and renovation business. A prospect was referred to me once — a homeowner with a tile job on a terrace who was shopping around for tile contractors.

My foreman and I met this buyer, asked a couple of questions and did some measurements — the usual stuff. The buyer had already purchased the tiles for the terrace; and he appeared to be certain that all that was left to do was to lay ’em tiles over the damn thing — as simple as it gets.

According to our observations: the tiles where interior-grade (which is a bad idea for exterior applications, given the climate zone), the substrate wasn’t properly prepared (leveling, slopes) and the question of waterproofing was unresolved.Never sell a Value buyer’s package to a Price buyer.

Given these complications and our concerns, we provided an estimate on the spot only to instantly discover that we were “out of our goddamn minds!” So we left — in hopes of finding better minds.

Eventually we did find one. It taught us a valuable lesson: never try selling a typical Value buyer’s package to a Price buyer.

Different types of buyers. Different types of sellers

Bear with me while I tie three of the following pieces of the puzzle together.

- According to the works of Reed K. Holden and Thomas T. Nagle, there are four types of buyers (plus one): Price buyer, Value buyer, Convenience buyer, Relationship buyer and Poker player. The Poker player is an amalgam of four primary buyer types. Different buyers, as their category names suggest, perceive what’s more valuable to them differently.

- According to the authors of The Trusted Advisor, there are four levels of relationship depth between the buyer and the service provider: Subject Matter or Process Expert, Broader Subject Matter Expert, Valuable Resource and Trusted Advisor. The underlying idea — the more trust between the parties, the more beneficial it is for the professional relationship.

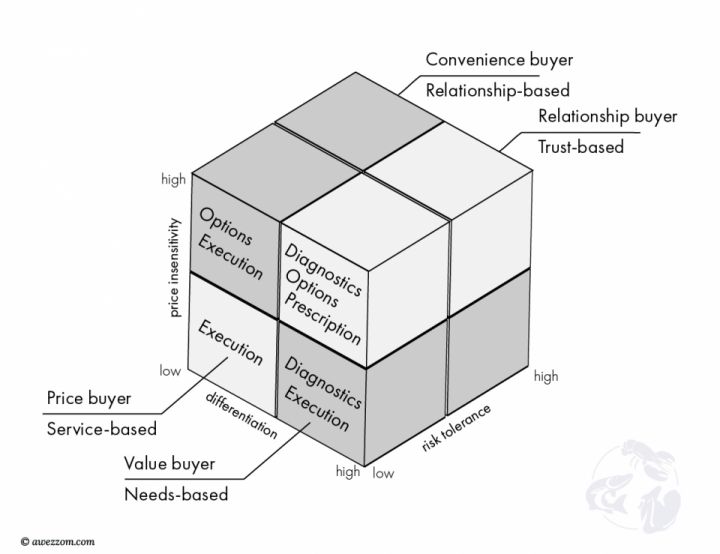

- The services PSFs provide to buyers can be broken into four distinct stages: Diagnostics, Prescription (advice), Options exploration and Execution (implementation). Some of your firm’s services will not have all of these stages, and, as we will discuss further, in many cases shouldn’t. The composition of these stages primarily depends on what kind of service provider you are (there are eight positioning categories).

If we map all of these aforementioned factors, we get a neat navigation tool for dealing with different types of buyers.

Price buyers are primarily interested in Execution, thus best served by Subject Matter-Process Experts who focus on Service-Based relationship, providing answers to well-specified buyer requests and implementing incoming orders.

Value buyers are interested in Diagnostics, no or very few Options exploration and in Execution, thus are best served by Subject Matter Experts who focus on Needs-based relationship, solving business problems.

Convenience buyers are interested in Options and Execution. Diagnostics are typically already done by other vendors or the buyer is coming self-diagnosed (sometimes correctly). This type of buyer is best served by Valuable Resource whose focus is Relationship-based, providing insights and ideas.

Relationship buyers are interested in Diagnostics, Options exploration and Prescription (professional recommendation, prudent advice). These buyers may want Execution from the same provider as well, but are supportive of the idea to shop for implementation elsewhere. This type of buyer is best served by the Trusted advisor whose focus is Relationship-based.I have invested my time (and petrol) in a non-existent opportunity.

As it was the case with the homeowner situation I’ve described, it is absolutely unnecessary to perform diagnostics and explore options with a price buyer. This type of buyer cares about one thing and one thing only — the lowest price. Mine and my foreman’s time, including travel expenses were wasted on an opportunity that didn’t exist.

I am guessing the homeowner wasn’t very pleased with time wasted on us either. Given that all frustrated prospects talk to other potential buyers, I can be certain: the brief interaction we had didn’t invoke a referral.

How to make sure we’re dealing with the right buyer

Who is the right buyer? Now, that is a million-dollar question. Because once you understand who is likely to buy from you and what they are actually buying, you’d instantly know who to hire, what incentives work best, what skills to develop, how to price your services, which ones to prune, how to market your firm, what margins you can expect, how big you can grow, and so on.

The answer to this question is multi-faceted. At its core the answer rests with what kind of service provider you are; in other words — your positioning. But at the level of how to make sure we’re not dealing with, say, a price buyer — that is a matter of buyer qualification. A set of standardized qualifying questions should do the trick.

There is an issue of a Poker player, of course — the one that acts a lot like other buyers, but there are ways to figure out where priorities are by juxtaposing mutually exclusive benefits. For example, if the buyer hints at lowest price, but is very curios about diagnostics and your professional opinion, this is likely not a price buyer.

Another thing you can do, prior to wasting your precious time on a non-match, is to send out a position paper. “Ten most common mistakes buyers face when . . .” paper that describes typical challenges a buyer like this (with this kind of project) is likely to face.

Then follow up to get buyer’s reaction. Price buyers won’t bother reading the paper. However, this move offers you a chance to convert an undecided buyer, which many business development folks strongly believe are capable of doing during a face-to-face meeting.

Obviously, if your firm is successful at targeting price buyers (and is willing to continue serving this segment) this marketing tool isn’t necessary.

Additional takeaways on the subject

Some other things to consider here. First, knowing the type of service provider you are and thus the type of buyers you ought to target, combined with the preferences your leadership and professionals have toward marketing, you can map marketing channels and tactics that are likely to work best for your firm.

Second, just like it makes sense to charge for execution, make sure you charge for diagnostics too. The same goes for options exploration and professional advice (prescription).

Third, your ideal service offering may have higher-tier phases, such as diagnostics followed by prescription. However, when you encounter a price buyer who is a good fit for your firm, it might be a very very good idea to cull the higher-tier parts and provide a good-quality execution of technical work and service. This has a direct impact on how entire firms should be positioned.

Finally, I could’ve explained the same idea using a 2x2 matrix. However, there is a reason why I’m using the 8-piece cube. The necessity for a third dimension (hence the cube) comes from buyer’s attitudes toward risk. If we examine closely, we can observe the tensions portrayed in this model.

For example, both the Price buyer and the Value buyer are price-sensitive. However, the more differentiated the service offering, the more likely it is to be priced (and valued) higher which creates a tension for such buyers. The same goes for risk axis. In order to avoid risk, price-sensitive buyers may be inclined to paying more which goes against their preference to pay less. This has a direct impact on how the service offerings, practice groups or entire firms should be positioned.

I will continue unfolding my ideas in the following articles. Eventually I’ll demonstrate how this 3D model ties with eight positioning categories available to professional service firms.

Subscribe, to be notified at once.

Edit: June 3, 2024

My further investigations into the subject of Buyer-Seller relationships led me to new discoveries. As of this moment, I stand corrected on my previous assumptions and conclusions.

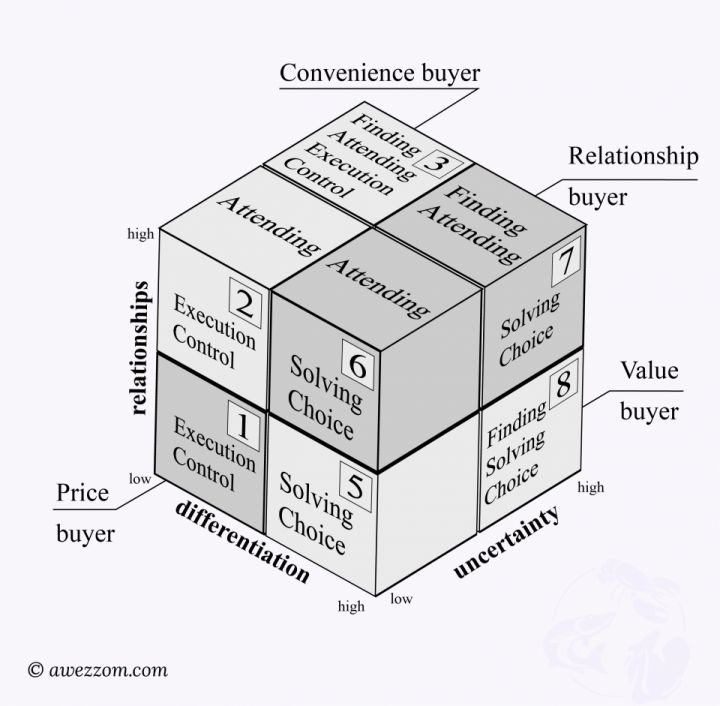

My analysis revealed that there are three fundamental dimensions that characterize buyer-seller relationships: (1) degree of Differentiation, (2) degree of Relationships, and (3) degree of Uncertainty. The presence of these dimensions does not change the isomorphism between buyer types and relationship types.

However, there are implications with regard to value creation activities, goal facilitators (prev.: value constituents), and sales strategies. The Price insensitivity and Risk tolerance (as well as Costs of search) emerge as a result of interplay between the three aforementioned fundamental dimensions.

As you can observe in Figure 2, there are six value creation activities that represent six (instead of five) main stages in service provision: (1) problem-finding and acquisition, (2) attending, (3) problem-solving, (4) choice, (5) execution, and (6) control and evaluation. This is based on the Value Shop concept (Stabell & Fjelstad, 1998).

The model portraits which value activities are of prime importance to specific buyer types. As depicted in octants 3, 4, 7, and 8, high degree of Uncertainty will push service providers to include problem finding and acquisition as a cornerstone of value creation activities.

Using this map, service providers may identify ways to adjust service offering’s components as well as their intensity to capture more value while simultaneously securing the integrity of value provided to buyers.

To interpret this map properly, one should understand that all six primary value activities may be present in a service offering. Those value activities listed in particular octants are the ones service provider should never dispense with, having a corresponding buyer type in mind.

For example, a Trusted advisor selling its services to a Relationship buyer may safely omit (or limit the intensity of) two value activities in its service offering design: (1) Execution, and (2) Control and evaluation. In practice, this scenario can be observed when a service provider works at a strategic level (e.g.) as a consultant, and then passes the client to another department specialized in execution; or refers client to an independent third party.

The reason for going through the trouble of value activities and goal facilitators, as well as service offering design (SOD) in general, is to ensure neither the buyer nor the seller are capturing value at the expense of one another. Taking advantage of the buyer is not a great long-term strategy. Allowing buyers to take advantage of your firm, is unsustainable business.

If you are interested in reading the full position paper on Map 5: Buyer Relationship Map, feel free to contact me via this website or email. See all proprietary management models here.

I’ve also published an article in LMA's Strategies&Voices in October, 2024. There, you will learn more about the topic: "Beneath the Service: What Law Firm Clients Really Buy." It’s written for lawyers, but is applicable to most professional services.

In my consultng practice, together with your team we attend to buyer types, value activities, and offering design in several advisory suites: (e.g.) Client Magnet Firm and Client Management suite.

The awezzom question of the day:

Which of our service offerings don’t match buyer types’ requirements?